Uses of Balance Sheet

What's On the Balance Sheet?

The balance sheet is a snapshot representing the state of a company's finances at a moment in time. By itself, it cannot give a sense of the trends that are playing out over a longer period. For this reason, the balance sheet should be compared with those of previous periods. It should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing.

A number of ratios can be derived from the balance sheet, helping investors get a sense of how healthy a company is. These include the debt-to-equity ratio and the acid-test ratio, along with many others. The income statement and statement of cash flows also provide valuable context for assessing a company's finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet.

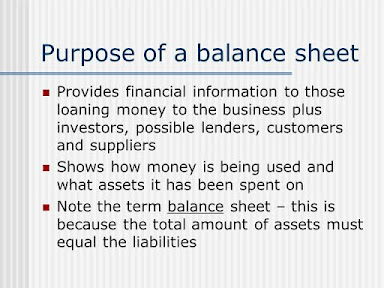

The purpose of a balance sheet is to give interested parties an idea of the company's financial position, in addition to displaying what the company owns and owes. It is important that all investors know how to use, analyze and read a balance sheet. A balance sheet may give insight or reason to invest in a stock.

Uses of the Balance Sheet

Below are some of the uses and importance of a balance sheet:

1. To Determine If Working Capital is Enough

The balance sheet is used to determine if the business has enough working capital to sustain its operation.

Working capital is the difference of current assets less current liabilities. It measures if the company still has enough current resources after deducting its due loan or obligations. If the result of computation is positive, that means the company is still doing okay. On the other hand, if the computation becomes negative, that means the company is in trouble. There’s a high risk of bankruptcy or inability to continue operating.

2. To Know the Business Net Worth

Net Worth is defined as the true value of an entity. It shows how rich or poor it is. It is computed by the difference of total assets less total liabilities.

In simple terms, net worth is the amount the investor/owner owns from the company after deducting all the liabilities.

3. To See If The Company Can Sustain Future Operation

By looking at the balance sheet, you can determine if the company can sustain future operation. To do this, look at the value of its non-current assets such as property, plant and equipment. If the total is higher than the current assets, it means the company has plans to sustain future operations. On the other hand, if the amount is already lower than the current assets, it can be an indication of inability to sustain future operation.

4. To Identify If There’s Possible Issuance of Dividend

Most business owners/investors are interested to know if when will they receive returns from their investment. Such returns can be in the form of Dividends. Dividends are issued if the company is profiting and has high amount of retained earning.

The balance sheet shows the balance of retained earnings. By looking at it, you can determine if the company has enough retained earnings or not.

Aside from the ones listed above, there are many other uses of balance sheet and it is really important for business owners to learn how to interpret it or have someone to interpret it for them.

Good

ReplyDeleteGood choice

ReplyDeleteThank you so much for sharing. I have found it extremely helpful…I’m off to modify some books!

ReplyDelete